Achievements

Established the product’s front-end architecture.

Design 20+ features E2E30+ features and functionalities designed end to end.

Created the Design Strategy that grew the product from a low-cost acquisition tool to a millon-dollar revenue generator.

Evangelised a user-centric approach in the product development process.

Shifted user behaviour from manual, tactical tasks to automated, strategic processes.

Help clients reduce significant cost on manual workflows and compliance risks

Contributed to making Lookup the top product in its category (per client feedback).

Through user interviews, desk research and Competitive Analysis, I identified the core challenges Tax Managers face:

Manual Processes

Without automation, the validation process was slow and prone to errors.

Frequent Validation Errors

Errors due to minor formatting issues led to frustration and inefficiencies.

Lack of Strategic Insights

Tax managers expressed a need for high-level insights to support compliance monitoring.

Aiding manual processes

Streamlining TINs upload, TIN format verification, etc. to showcase an intuitive tool, simplifying the technical aspect of an API-first product in sales demos.

Provide guidance and feedback

To minimise errors, enhance Tax Managers’ self-serve capability and operational efficiency.

Introduced to reduce high error rates caused by incorrect data formatting. Early usability testing revealed users struggled with data formatting for TIN validation.

Offer a clear guide with a downloadable CSV template, enabling users to input data accurately and minimise formatting errors.

Impact on User Workflow

Enable Tax Managers to understand data requirements and upload TINs manually with minimal efforts and errors

Strategic Impact

Clarifies data requirements, reduced client's effort to understand data required, improving client's satisfaction (NPS to be calculated)

Increased product's MAU by 25% one month after launch

Boost product appeal in demos, opening up commercial opportunities.

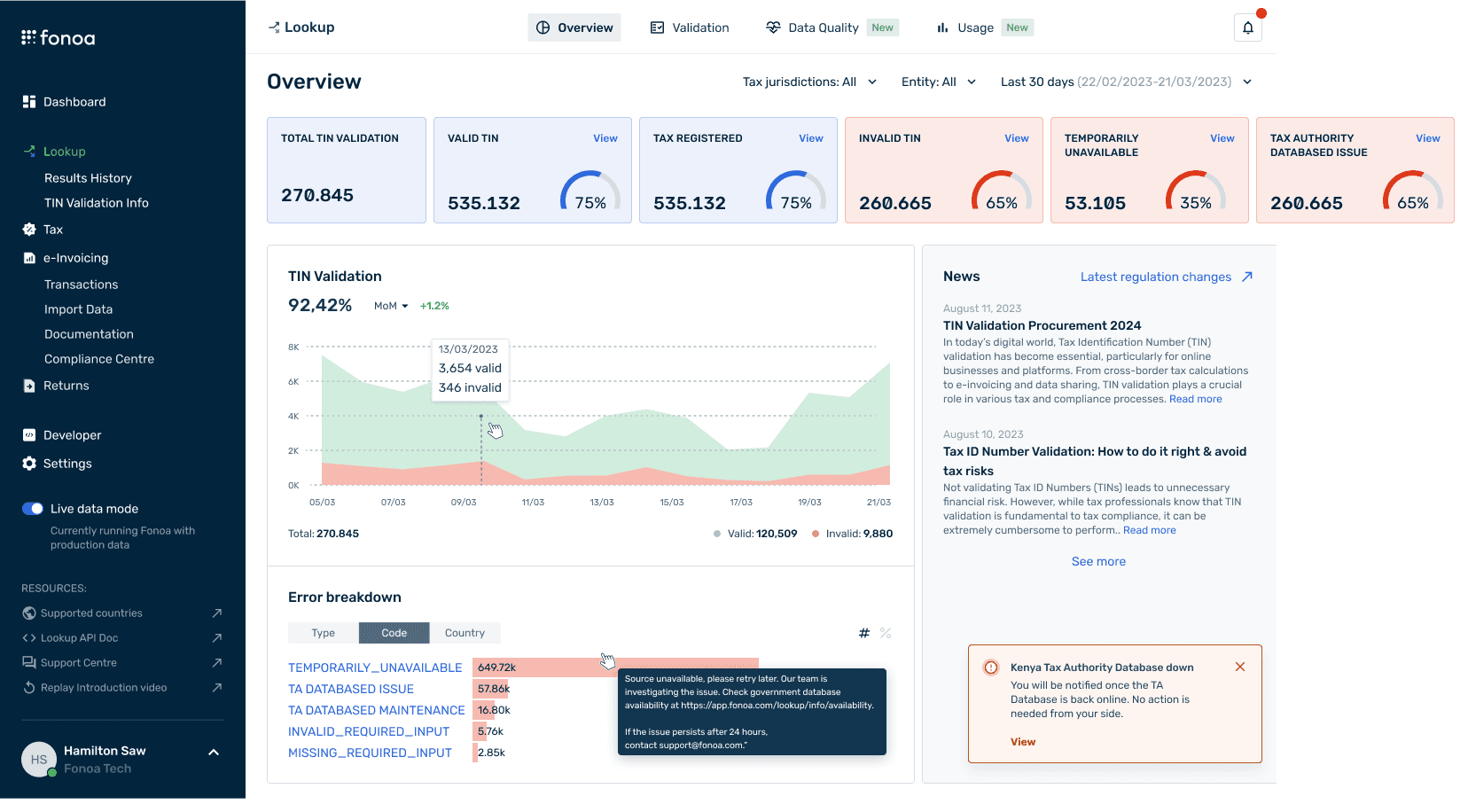

As Lookup matured, a need emerged for high-level insights to support strategic decision-making, especially for enterprise clients.

Leverage data visualisation to present insights clearly, minimising the effort required to interpret data.

Impact on User Workflow

The added strategic layer and actionable data empower Tax Managers to allocate resources efficiently, resolve recurring issues, and take a proactive compliance approach.

Strategic Impact

With enterprise-grade analytics, Lookup evolved into a comprehensive compliance management solution, attracting large clients and boosting retention. This positioned the product as a premium offering, significantly contributing to its growth into a million-dollar revenue generator.

Craft clear, helpful error messages.

Present error analytics in an insightful format, transforming error management from a guessing game into a structured, preventable process.

Impact on User Workflow

With actionable error descriptions and analytics, Tax Managers can address compliance errors swiftly and independently, minimizing delays and support dependency.

Strategic Impact

Standardised and improved errors messages across different Tax authorities and languages (+20).

Creates a unified troubleshooting framework share by clients, Fonoa CX, Sales Engineers, Engineering, and Product. This closed-loop approach minimises reporting disruptions and empowers users to resolve issues autonomously.

Error rates decreased by 8.5% one month after launch.

Reduced CX tickets by 12%.

Iterations

Balancing Feature Expansion without Feature Creep

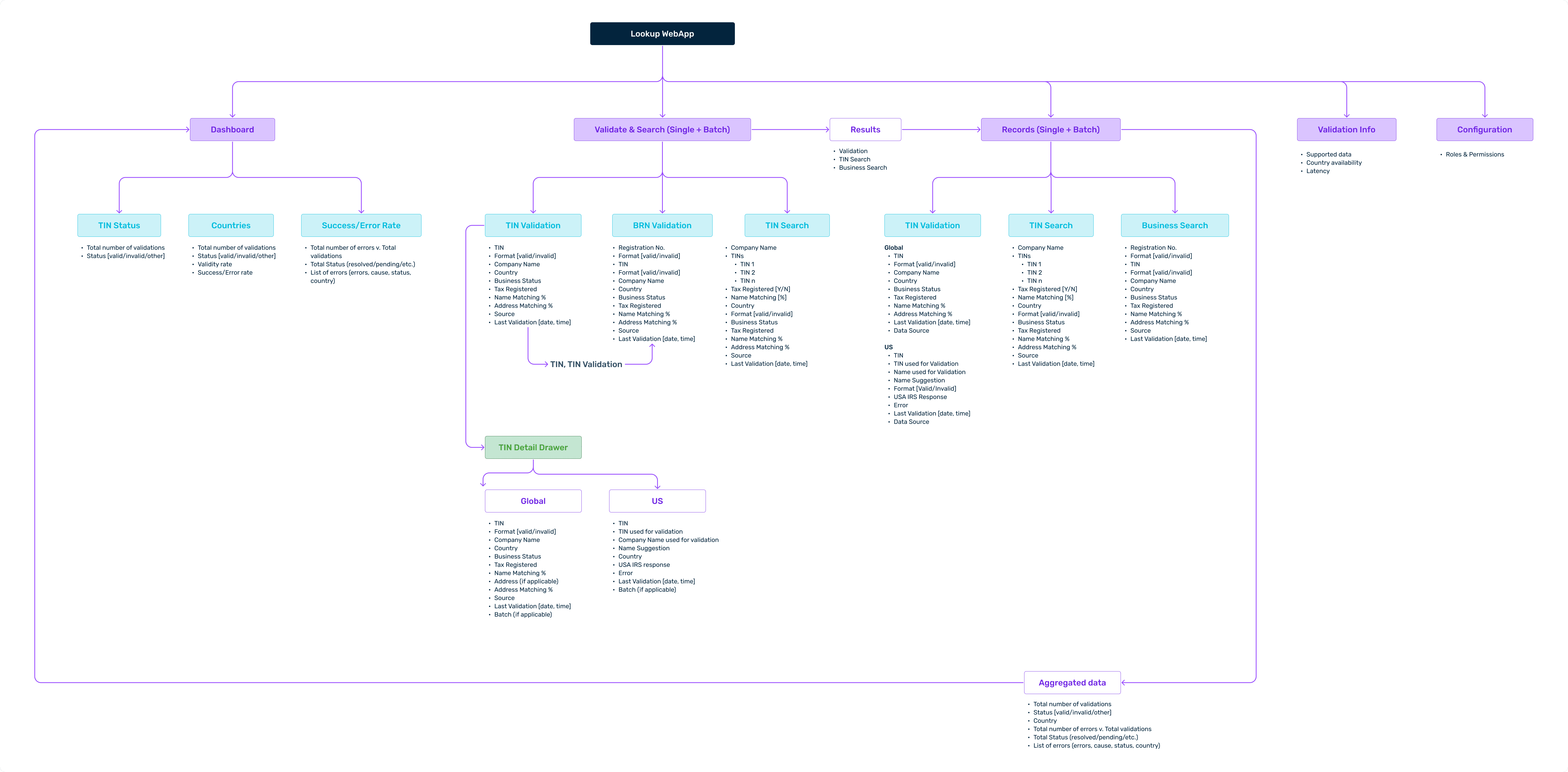

As client interest grew, alongside rising feature requests and the addition of more robust product capabilities, I refined the product’s front-end architecture to centre around core user JTBDs—validating and extracting insights from TIN validations. This approach ensured essential features remained prominent while integrating complementary enhancements to improve workflow efficiency, avoiding feature creep and minimising cognitive overload.

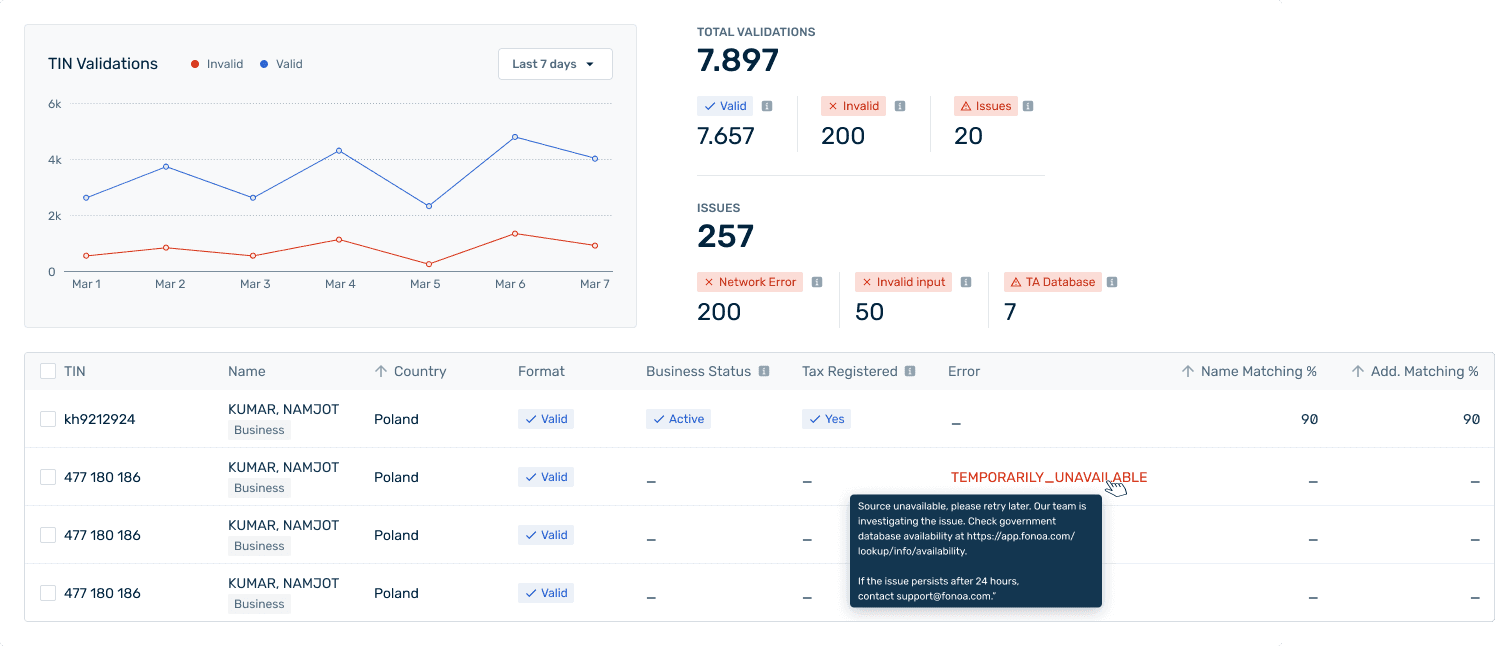

Initially, the Validation page presented Single and Batch validators separately to align with existing workflows. However, user insights revealed that this mental model stemmed from limitations in legacy government databases or competitor systems based on data ingestion modes (single or batch of TINs).

I realised that users’ primary goal was to understand the TIN status and gather insights from the validation, rather than the act of validation itself. To address this, I iterated on the design by regrouping the Single and Batch Validator with their respective results into two pages: Validate (Single & Batch) and Records (Single & Batch). This restructuring aimed to streamline workflows and provide faster access to results.

Impact on User Workflow

Simplifying the validation flow removed an extra step between task and outcomes, providing the results directly, enhancing the user's decision-making capability and transforming their approach from tactical to strategic.

The users reported to be less concerned about how to validate TINs and more about the validation results, which impact their business directly.

Takeaways

A user-centric design strategy should always be adaptable and ready to evolve with the product.

By uncovering and addressing users’ Jobs To Be Done (JTBDs), you ensure the product meets essential user needs while leaving space for growth and innovation.

An adaptable design strategy starts by envisioning the ideal state or achieving product-market fit, then scales back to an MVP. This approach balances meeting current user needs and business goals with maintaining innovation and scalability for the future.

Fewer feature, more impacts

Adding a CSV guide with clear instructions and a downloadable template reduced errors from incorrect data formatting. Small, user-centric features can have a substantial impact on user experience and efficiency, demonstrating attention to detail that enhances both functionality and client satisfaction.

Streamlining Validation Workflow and Unifying Modes

By consolidating Single and Batch TIN Validation modes, the product simplified the workflow and shifted focus to results rather than processes. Simplifying workflows by aligning product architecture with user goals and needs rather than traditional workflows improves efficiency, encourages new user behaviour, and enhances overall satisfaction.